TV CONGRESS:

Analyzing Political Broadcast Media

Tools and analysis of 2020, 2022 and 2024 general election ads and spending for Way to Win, with data from Dailykos Elections and AdImpact.

Welcome to TV Congress, Way to Win's analysis of Democratic messaging. This is based on data on broadcast ads, via AdImpact ad intelligence combined with data sourced from from The Downballot (formerly know as Daily Kos Elections). Please feel free to share screenshots from here or link to it at the canonincal URL (waytowin.us/tvcongress), credit "Way to Win TV Congress Media Analysis" where appropriate, and use #tvcongress for discussion on social media.

Presidential General By

Party/Party+Tone/Advertiser Type/Advertiser/Issue | By

Keyword

D $513.8M R $437.0 (Dem Spend Δ +8.1%)

Presidential Primary By

Party/Party+Tone/Advertiser Type/Advertiser/Issue

D $171.9M R

$211.0 (Dem Spend Δ -10.2%)

Future Forward vs MAGA Inc. By Party/Party+Tone/Advertiser Type/Advertiser/Issue

| By

Keyword

Trump for Pres vs Harris for Pres By Party/Party+Tone/Advertiser

Type/Advertiser/Issue | By Keyword

The Whole Enchilada (Presidential + Senate +

Congress) By

Party/Party+Tone/Advertiser Type/Advertiser/Issue | By

Keyword

D $1,808.6M R $1,702.1 (Dem Spend Δ +3.0%)

Top Creatives (Presidential General) All | Immigration | Economy

The Big House

Table

All races included - for competitive races (ones where

both D and R spending > $0), click the Dem Spending Differential

amount to see a breakdown of the ads in each competitive district.

Winnable districts are Trump districts where the 24 House Dem lost by

less than 5, and 3 Harris districts held by Rs.

All US House Ads By Party/Party+Tone/Advertiser Type/Advertiser/Issue

| By

Keyword

D $442.8 R $316.0 (Dem Spend Δ +16.7%)

All US Senate Ads By Party/Party+Tone/Advertiser/Issue | By Keyword

D $522.3M R $557.3 (Dem Spend Δ -3.2)%

All Outside Ads By Party/Party+Tone/Advertiser/Issue | All Outside Ads

By Keyword

House Issue

Groups

General + Primary: D $304.5 R $273.4 (Dem Spend Δ

+10.2%)

Senate Issue

Groups

General + Primary: D $274.6 R $450.4 (Dem Spend Δ

-64.0%)

AZ Senate

Gallego (D) 50.1% def

Lake (R) 47.7%

MI Senate

Slotkin (D) 48.6% def

Rogers (R) 48.3%

MT Senate

Sheehy

(R) 52.6% def

Tester (D) 45.5%

NV Senate

Rosen

(D) 47.9% def

Brown (R) 46.2%

OH Senate

Moreno

(R) 50.1% def

Brown (D) 46.5%

PA Senate

McCormick (R) 48.8% def

Casey (D) 48.6%

TX Senate | By Keyword

Cruz (R) 53.0% def

Allred (D) 44.6%

VA Senate

Kaine

(D) 54.4% def

Cao (R) 45.4%

WI Senate

Baldwin (D) 49.3% def

Hovde (R) 48.5%

For this cycle, we analyzed races at the national, state and governor levels. The primary links will take you to a page with breakdowns by party, party + tone (i.e. the message box), by advertiser, and by issue. (as coded by AdImpact) Read the 2022 summary memo for analysis from this cycle.

The Big House

Table

All races included - for competitive races (ones where

both D and R spending > $0), click the Dem Spending Differential

amount to see a breakdown of the ads in each competitive

district.

All US House Ads By Party/Party+Tone/Advertiser/Issue | US House Ads By Keyword

Likely 2024

Competitive Districts

D $241.7M R $192.4 (Dem Spend Δ

+25.6)%

(24 districts total: 18 where Biden won or 19 where the Dem

lost by less than 5)

All US Senate Ads By

Party/Party+Tone/Advertiser/Issue | US Senate Ads By

Keyword

D $296.7M R $235.0 (Dem Spend Δ +26.3)%

All Outside Ads By

Party/Party+Tone/Advertiser/Issue | All Outside Ads By

Keyword

House Issue

Groups

General Only: D $130.1 R $140.2 (Dem Spend Δ -7.8%)

General + Primary: D $153.8 R $190.0 (Dem Spend Δ -23.5%)

Senate Issue

Groups

General Only: D $140.6 R $157.3 (Dem Spend Δ

-11.9%)

General + Primary: D $182.5 R $258.5 (Dem Spend Δ

-41.6%)

Combined House

+ Senate By Party/Party+Tone/Advertiser/Issue | Combined

House + Senate By Keyword

Senate Crime and NOT Abortion ads | House Crime and NOT Abortion ads

AZ

Governor

Hobbs (D) 50.3% def Lake (R) 49.7%

AZ Senate

Kelly (D)

51.4% def Masters (R) 46.5%

FL Governor

DeSantis

(R) 59.4% def Crist (D) 40.0%

FL Senate

Rubio (R)

57.7% def Demings (D) 41.3%

GA Governor

Kemp (R)

53.4% def Abrams (D) 45.9%

GA Senate | By Keyword

Warnock (D) 51.4% def Walker (R) 48.6%

NV Governor

Lombardo

(R) 48.8% def Sisolak (D) 47.4%

NV Senate

Cortez Masto

(D) 48.9% def Laxalt (R) 48.0%

PA Governor Shapiro (D) 56.5% def Mastriano (R) 41.7%

PA Senate | By Keyword

Fetterman (D) 51.2% def Oz (R) 46.3%

WI Governor

Evers (D)

51.2% def Michels (R) 47.8%

WI Senate | By Keyword

Johnson (R) 50.5% def Barnes (D) 49.5%

Update: Greg Sargent interviewed the architect of this project, Jenifer Fernandez Ancona, and wrote up an excellent summary in the Washington Post, Can Democrats avoid the pitfalls of 2020? A new analysis offers striking answers.

The 2020 fight for the US Congress ended with a mix of good news and bad for Democrats. Democrats retained their majority, even while going zero for twenty seven in the the Cook Political-rated D and R tossup races. Centrist Democrats were quick to blame the left. Yet Republicans had publicly announced a strategy based on name-calling early in the cycle, in February of 2019. It seems possible that a more aggressive strategy to combat it could have been waged - an argument advanced by Justice Democrats and other groups in their preliminary 2020 analysis. While research alone will not lead to persuasive, powerful, and emotionally resonant ads, it is of particular necessity when communicating with exactly the kinds of divese audiences that proved pivotal in many districts. In many races, these groups of voters had been categorized as "mobilization" segments, and were thus deprioritized for spending and focus.

The good news is that Democratic leadership has already begun taking aggressive action to address these issues. When Rep Maloney was elected to run the DCCC, one of his first actions was to end the blacklist that had limited new consulting firms from competing. But given the historic challenges Democrats face in 2022, it's going to take a lot more than this. To support this effort, Way to Win commissioned a study of the overall 2020 message landscape. These interactive tools were one result.

Many thanks to Dailykos Elections Data for their excellent work, and to AdImpact for allowing these views of their datasets to be made public. If you'd like to inquire about their ad intelligence or obtaining copies of their data for post-cycle analysis, please contact John Link at AdImpact directly.

The interactive tables are not mobile adapted. Please view them on a larger screen. Please feel free to share screenshots from here or link to it, and credit "Way to Win analysis of AdImpact, DailyKos Elections, and Cook Political data by Dan Ancona."

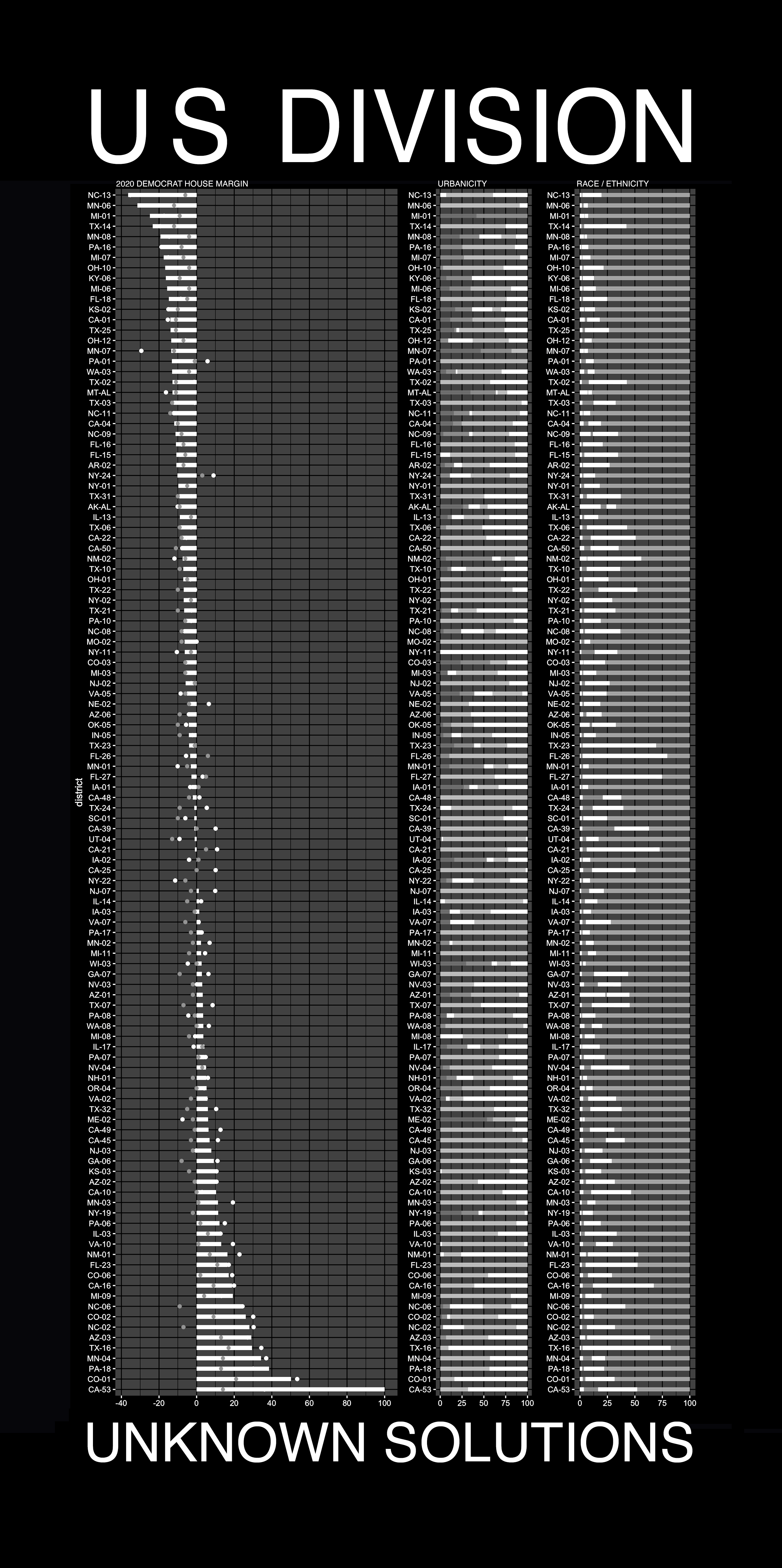

The previous image, but in the iconic style of the cover of Joy Divison's 1979 release, Unknown Pleasures. Many thanks to James Home for getting the design execution just right.